Description

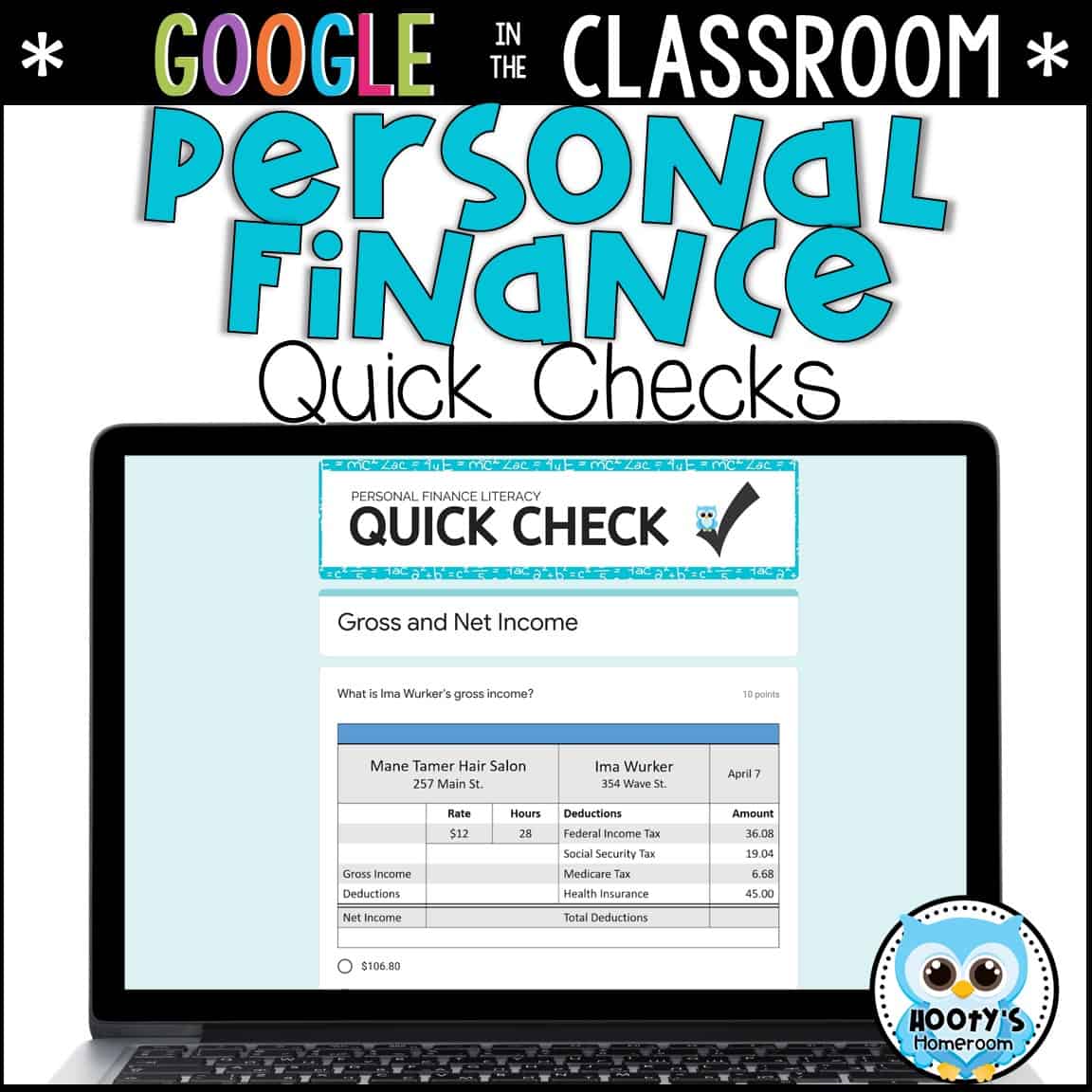

Save precious time with self-grading daily math assessments! Quickly check your students’ understanding of personal financial literacy skills with quick, daily math assessments that are perfect for busy teachers. Not only are Google Forms self-grading, but they are easy to assign to students.

Tired? Stressed?

Save your precious time by using self-checking assessments and let Google Forms do the grading for you. Instead of grading, you can devote time to analyzing data from your Google Forms to plan interventions. Trying to do it all will wear you out!

Save 30% by purchasing the 5th grade bundle.

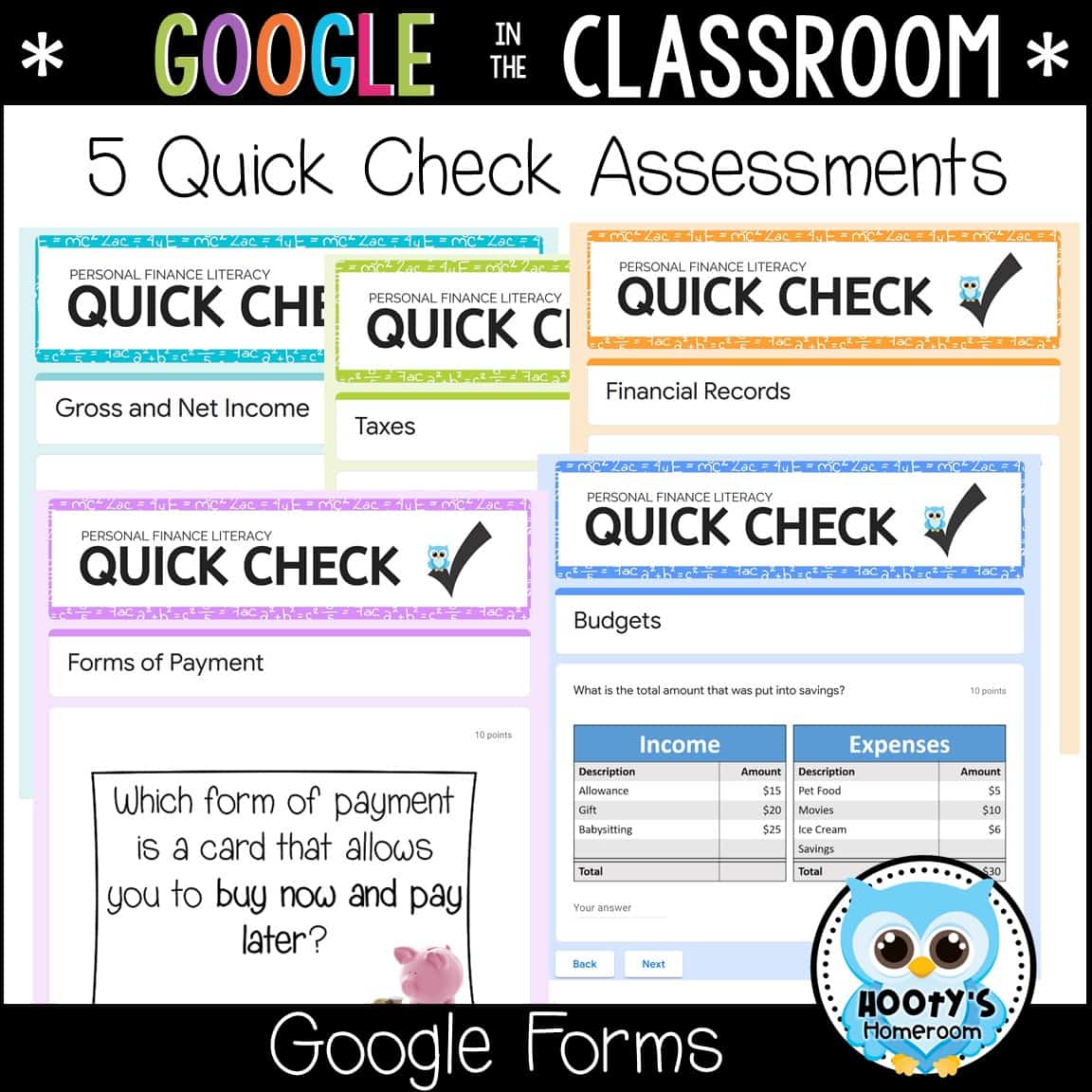

Personal Financial Literacy skills covered:

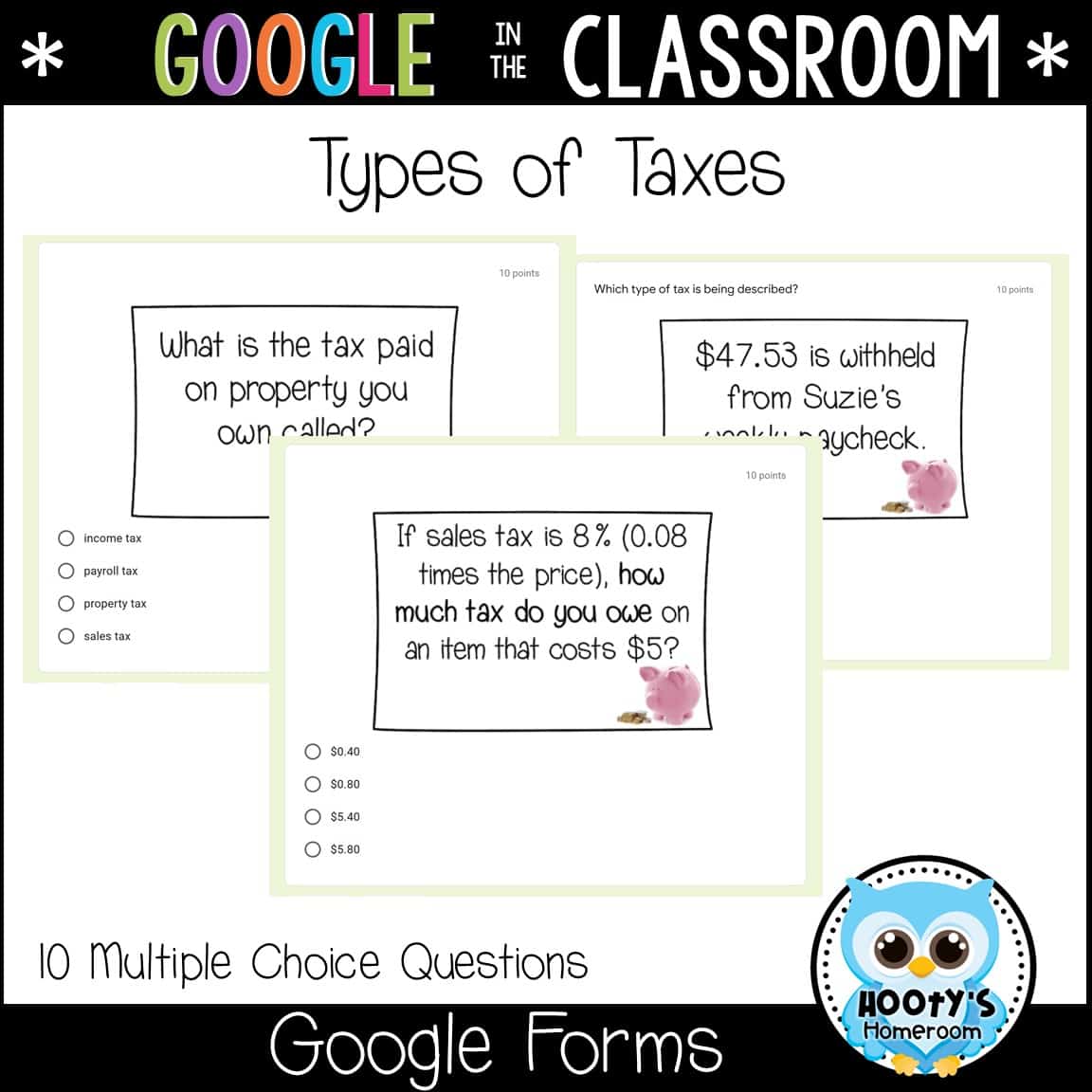

- Types of Taxes

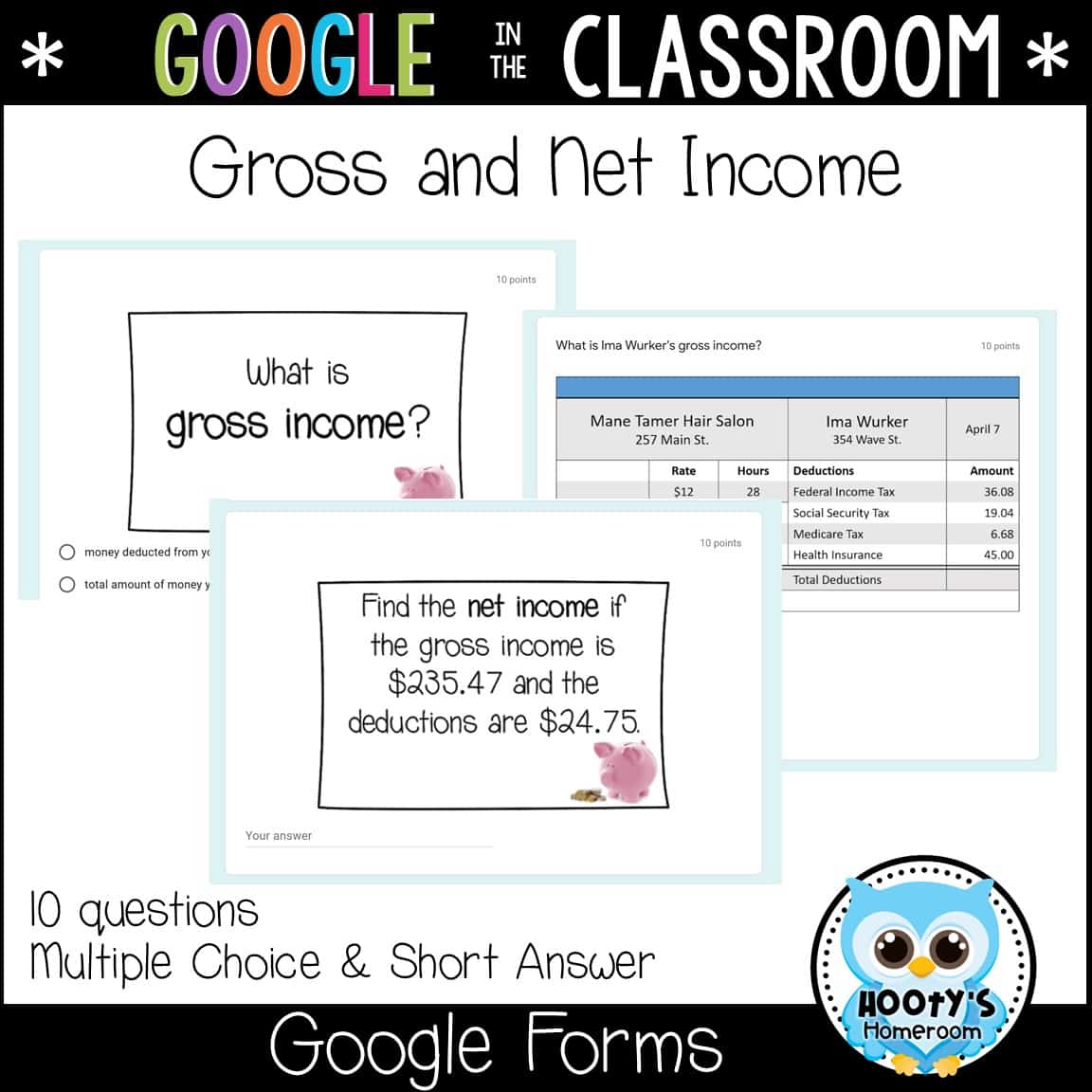

- Gross & Net Income

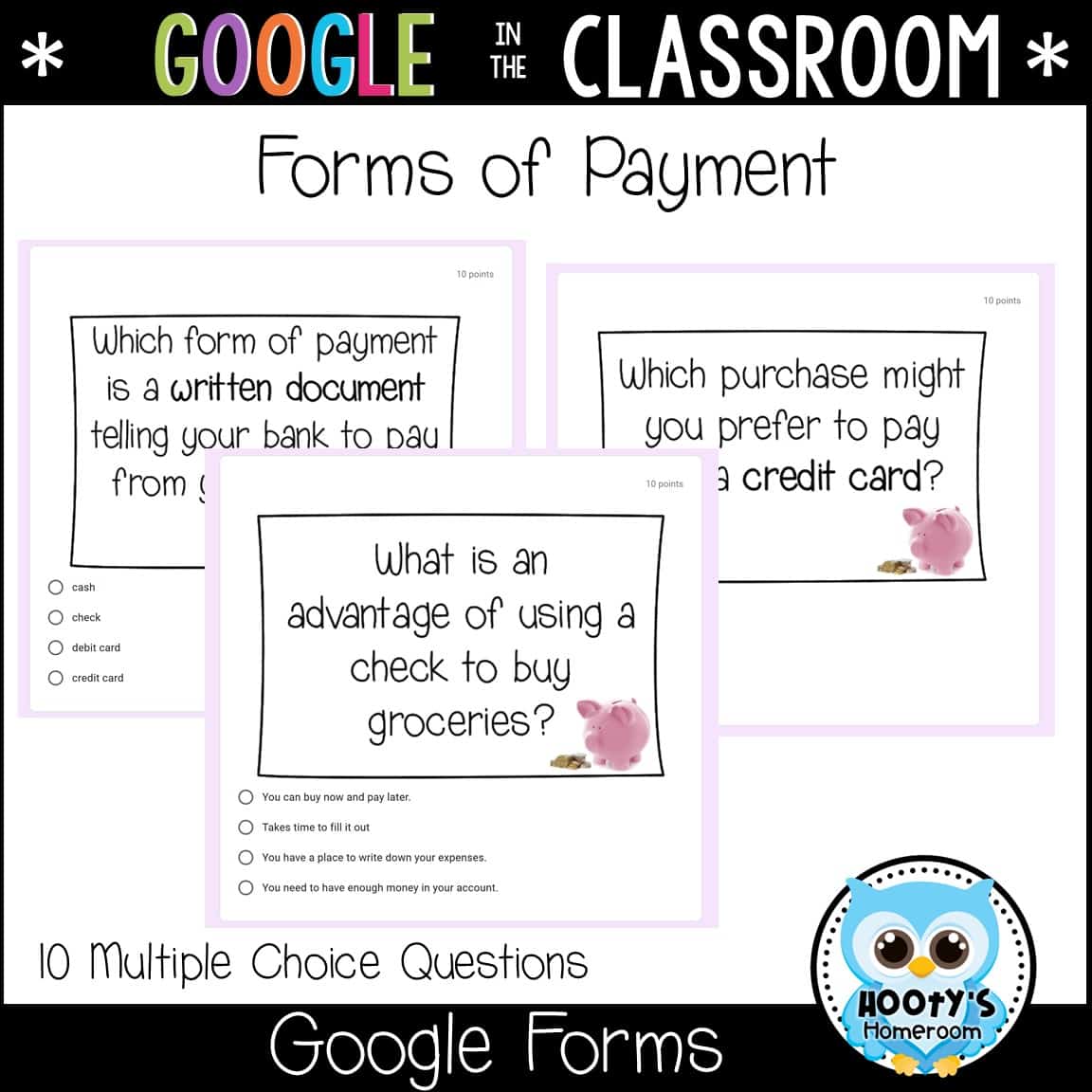

- Forms of Payment

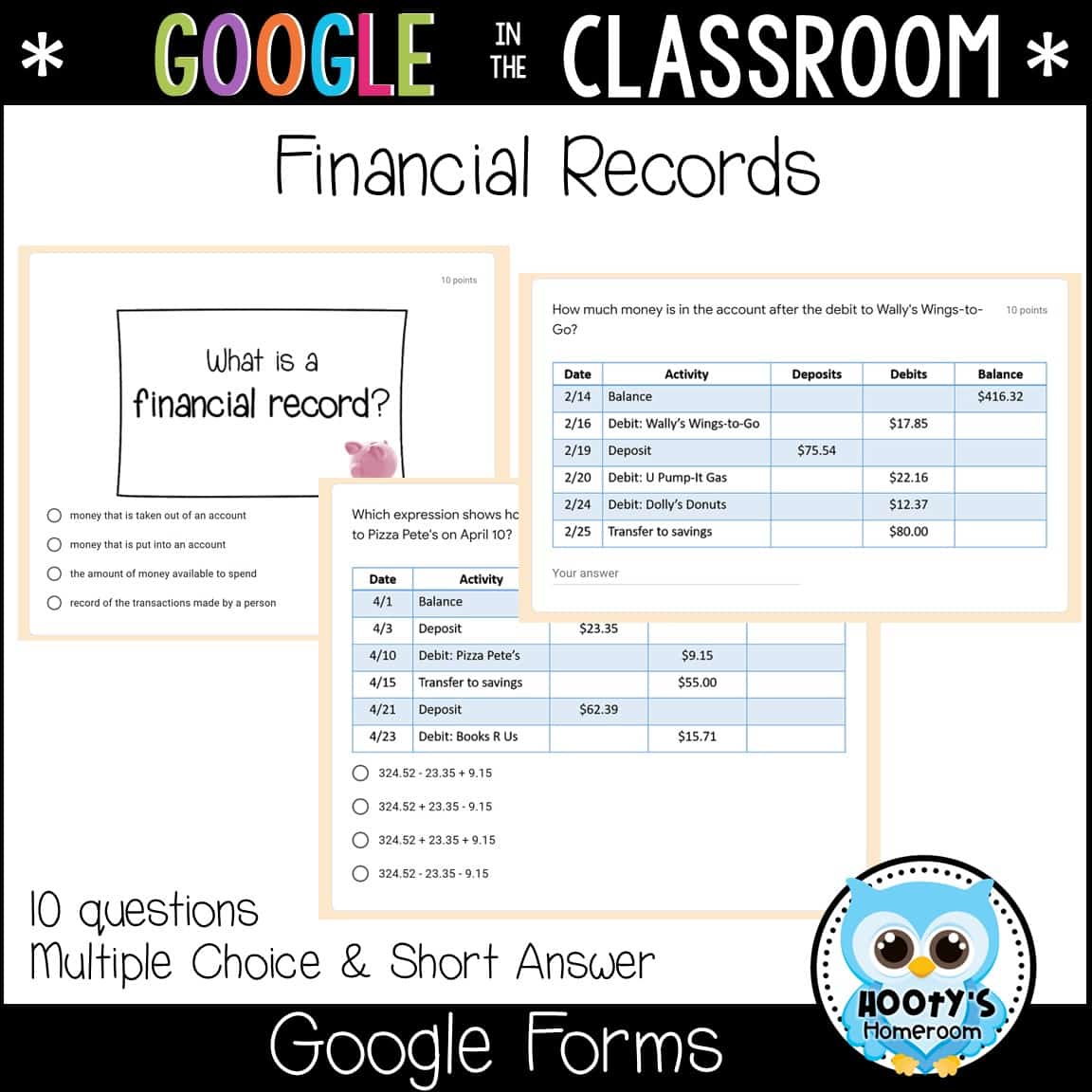

- Financial Records

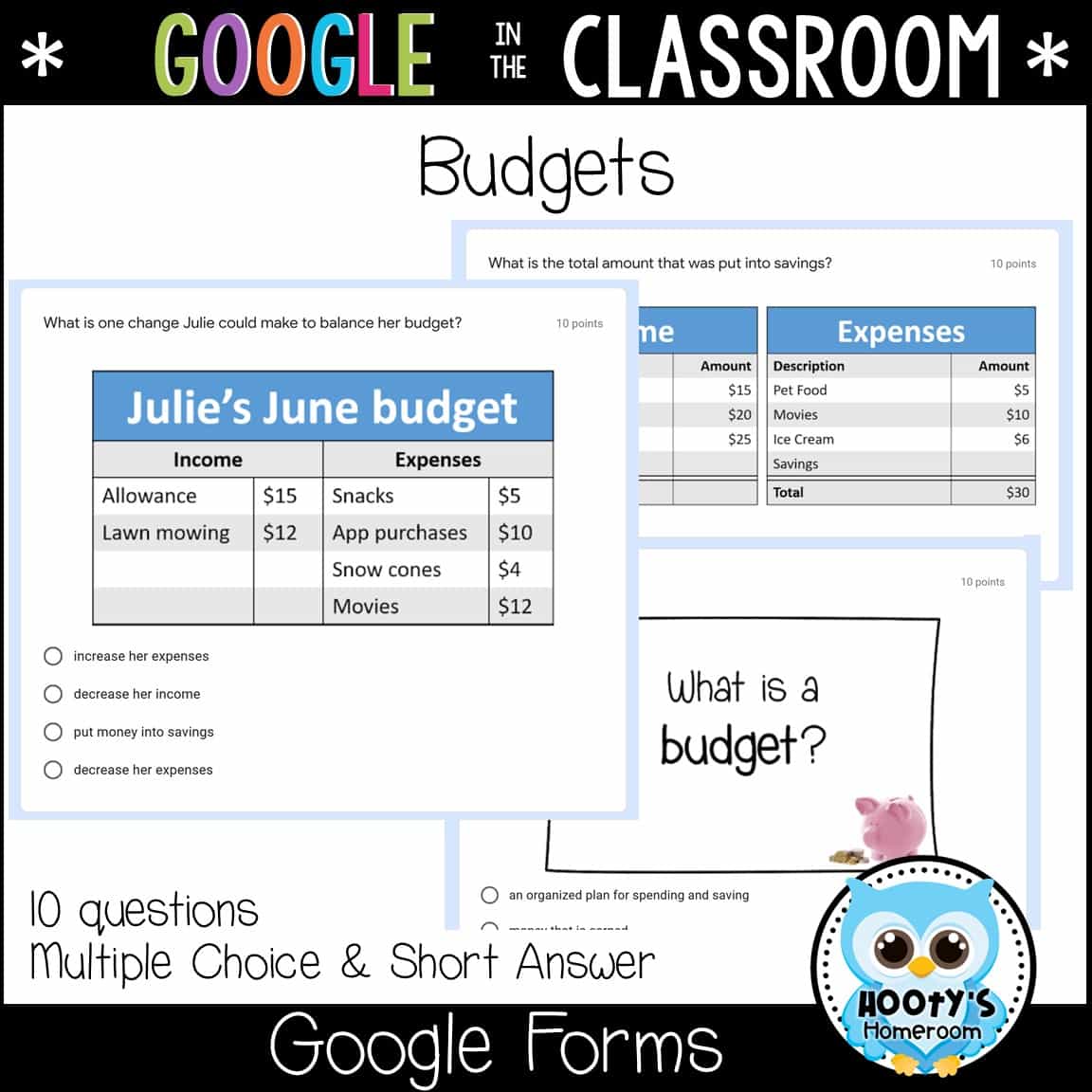

- Budgets

What’s included:

- 5 quick check daily assessments

- Google Forms Getting Started Guide

This resource supports the following 5th grade Personal Finance Literacy TEKS:

TEKS 5.10A – define income tax, payroll tax, sales tax, and property tax

TEKS 5.10B – explain the difference between gross income and net income

TEKS 5.10C – identify the advantages and disadvantages of different methods of payment, including check, credit card, debit card, and electronic payments

TEKS 5.10D – develop a system for keeping and using financial records

TEKS 5.10E – describe actions that might be taken to balance a budget when expenses exceed income

TEKS 5.10F – balance a simple budget

What teachers are saying…

⭐⭐⭐⭐⭐ “These quick checks are spot-on for checking in with the students to see where their understanding is for financial literacy. The forms allow me to quickly see where each student is lacking or excelling in their understanding, and reteach when necessary. The forms are quick and easy to assign and check, and anything on the computer gets my students excited and engaged.” – Sherry L.

⭐⭐⭐⭐⭐ “Used it as homework for our Personal Financial Literacy Unit and it took SSSOOO much work off of me making my own! Great and quick way to access learning and retention through a unit that is heavy on vocabulary.” – Lindsey N.

⭐⭐⭐⭐⭐ “Excellent to help solidify learning. Students expected a quiz (or key questions) the day after their lessons. Quizzes helped build confidence and allowed me to spend more time with students that we not understanding certain concepts.” – Val G.

✔️ Click here to view more self-grading Google Forms resources.

Did you know you can customize this Google Forms resource?

Here are some ways you can edit this resource:

- Change the answer format from short answer to multiple choice

- Add/delete answer choices

- Add your students’ names to the typed word problems

Note – Some of the questions are images and cannot be changed.

Sharing with your students is easy! These assessments can be emailed or assigned in Google Classroom.

View Personal Financial Literacy Google Forms on Teachers Pay Teachers.

Copyright © Hooty’s Homeroom

All rights reserved by author.

Permission for single classroom use only.

SKU# 5362124